Overview

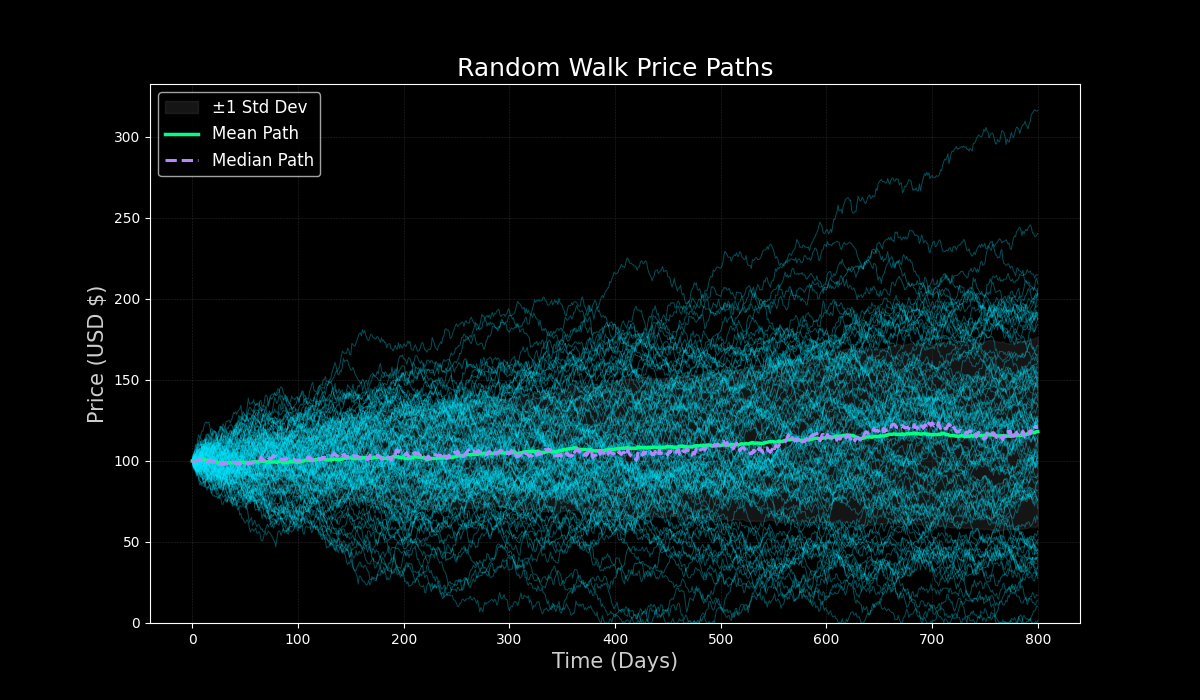

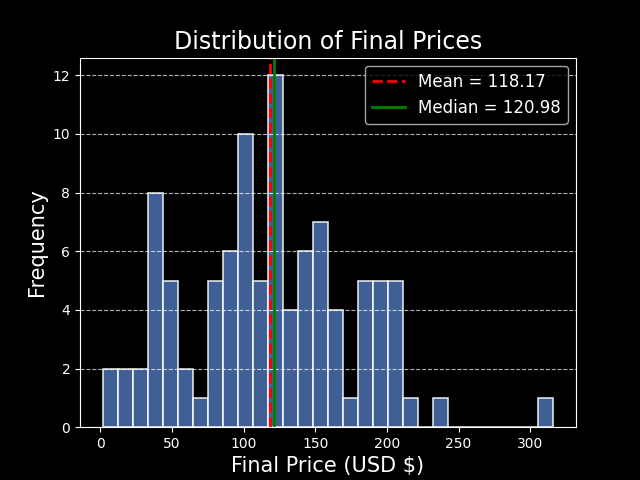

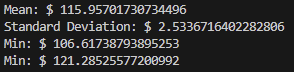

This simulator models a discrete-time random walk for an asset price. Each step applies a drift, producing many possible price paths that illustrate how uncertainty compounds over time. By simulating hundreds of trajectories, the model visualises the probabilistic spread inherent in stochastic systems.