Snapshot

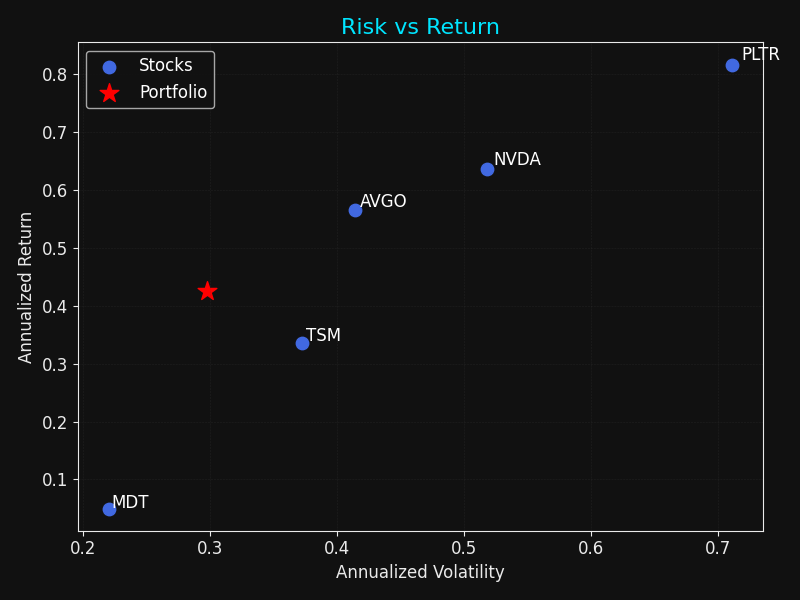

Yearly return and volatility across assets.

Built with NumPy, Pandas, Matplotlib and yfinance.

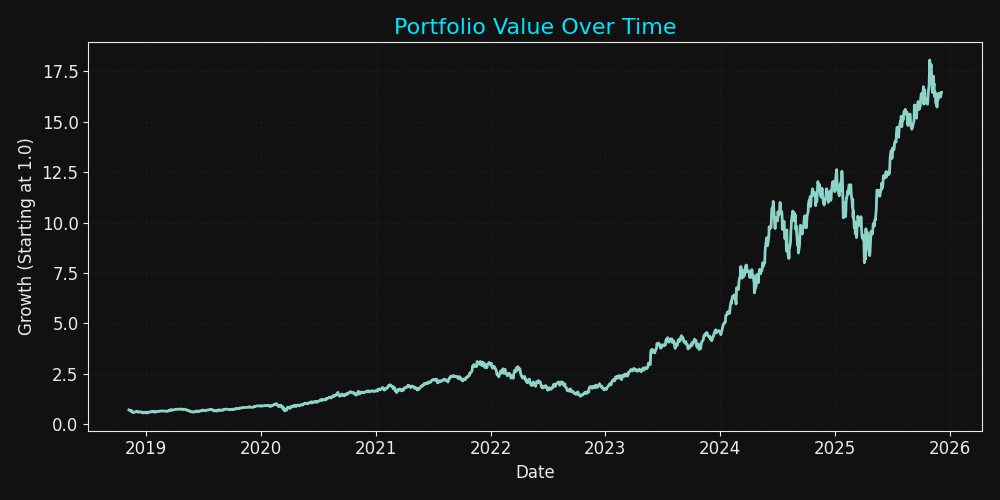

Portfolio Growth Curve

Visual Outputs

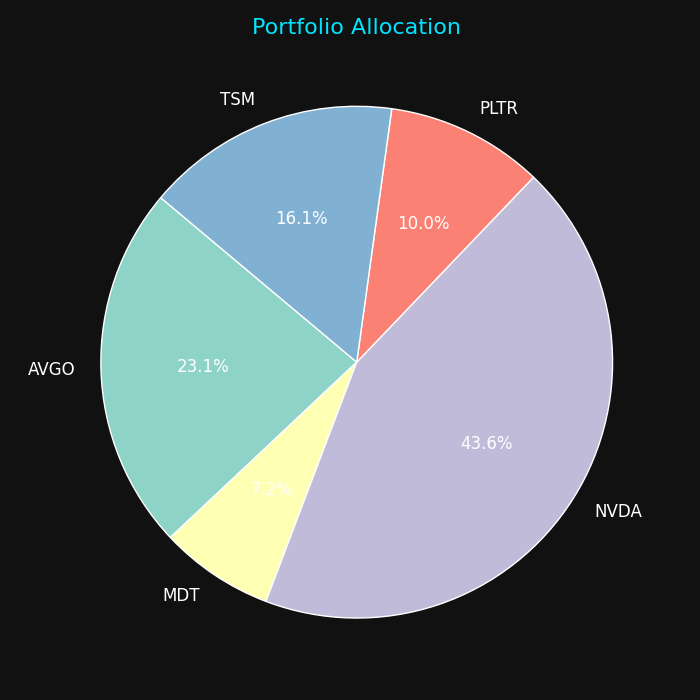

Asset Allocation

Distribution of assets displayed with a pie-chart breakdown.

Risk vs. Return

Annualised volatility vs. expected return for each asset and portfolio.

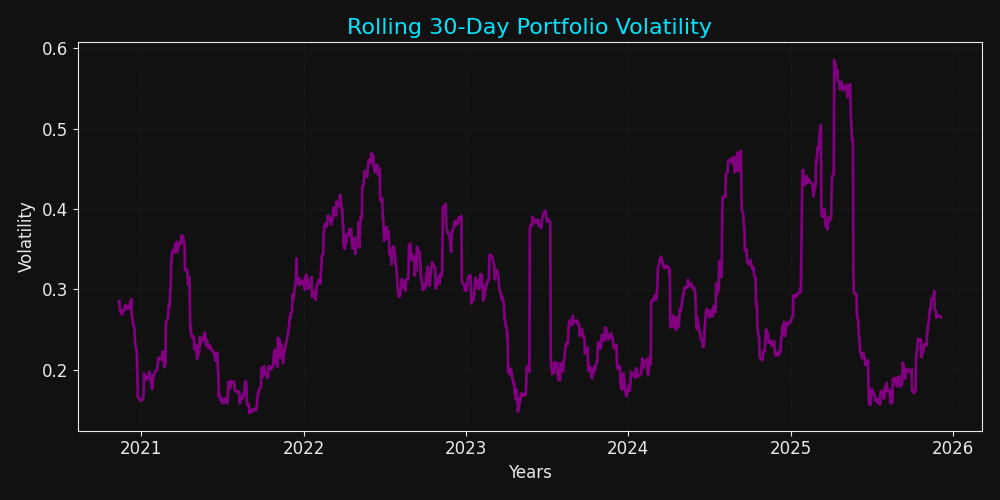

Rolling Volatility

30-day rolling volatility highlights periods of elevated market stress.

Methodology

1. Data Gathering

Uses yfinance to download adjusted closing prices for a set of tickers,

put into a price matrix.

2. Return & Covariance Model

Computes daily returns, annualises mean and volatility. Then constructs a covariance matrix to show relationships between assets.

3. Portfolio Construction

Applies user-defined weights to derive portfolio-level return, risk and Sharpe ratio. Then visualises key outputs in plots seen.